Stuck choosing between TradingView and TrendSpider?🤔 You\\\’re not alone. The trading world is buzzing with questions about which platform reigns supreme.

Whether you\\\’re a seasoned trader or just starting out, the decision can be daunting. But worry not! We\\\’re here to guide you through the maze.

In this blog, we\\\’ll pit TradingView against TrendSpider, comparing their features, ease of use, and unique offerings.

By the end, you\\\’ll have a clear winner in mind for your trading needs. Let\\\’s dive into the world of charts and patterns and find your perfect trading partner!💥

TradingView vs TrendSpider: A Tale of Two Titans in the Trading Arena

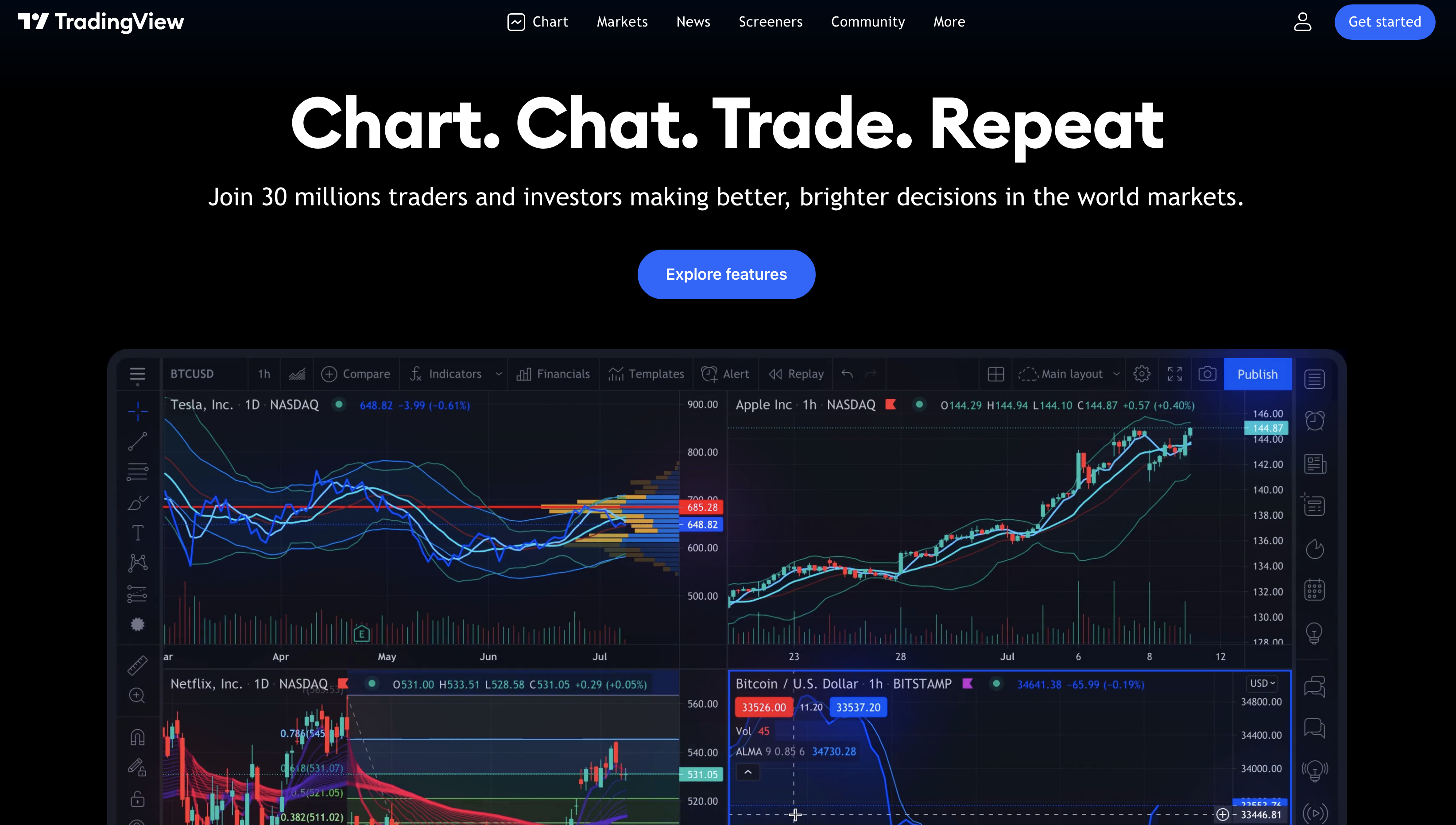

💹 TradingView

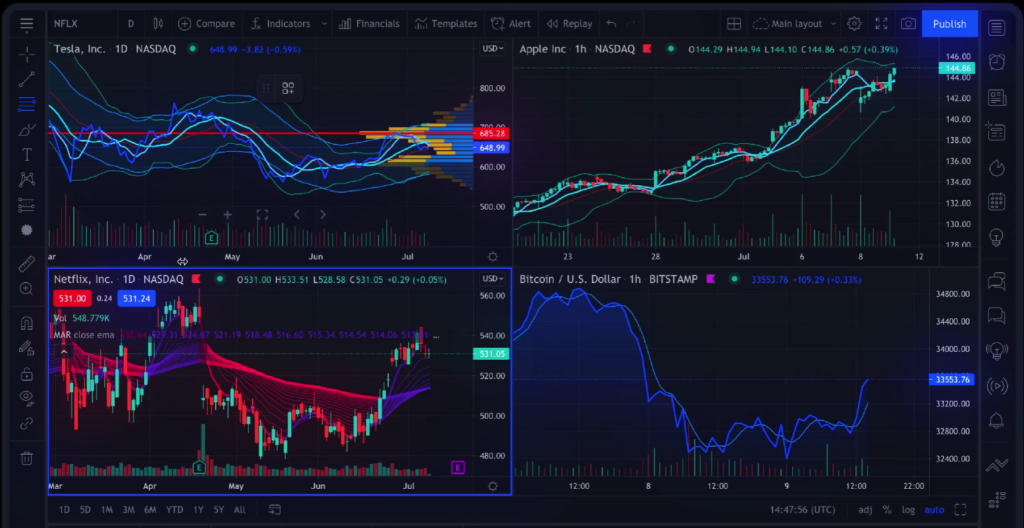

TradingView is a comprehensive, web-based charting and analysis platform used by traders and investors to track and analyze financial markets. It offers a range of tools including interactive charts, a wide array of technical indicators, and drawing tools for conducting technical analysis on various markets like stocks, forex, cryptocurrencies, and more.

Additionally, TradingView is known for its social network features, allowing users to share ideas, strategies, and insights with a community of traders. It caters to users of all levels, from beginners to advanced traders, with an intuitive interface and customizable charts.

🕸️ TrendSpider

TrendSpider is a sophisticated trading platform tailored for experienced traders, emphasizing automated technical analysis and chart pattern recognition. It streamlines chart analysis by automatically identifying trends, patterns, and Fibonacci levels, greatly aiding in efficient market evaluation.

TrendSpider offers a robust set of features including customizable indicators, smart charts, real-time data scanning, and a powerful backtesting engine, all designed to help traders spot opportunities and validate strategies quickly. Primarily, TrendSpider suits traders who prefer a high level of automation and detailed analysis in their trading workflow.

User Interface and Experience

- User-Friendly: TradingView is celebrated for its straightforward and easy-to-navigate interface. This makes it ideal for beginners or those who prefer a clean, uncluttered trading environment. The platform allows users to access its tools and features with minimal learning curve.

- Customization: Users can personalize their charts and workspaces to fit their trading style. This includes changing layouts, colors, and the types of charts and indicators displayed.

- Complex Interface: TrendSpider offers a more advanced interface that caters to seasoned traders. This complexity can be overwhelming for beginners but provides in-depth analysis tools for experienced traders.

- Advanced Customization: It offers greater depth in customization, particularly beneficial for technical traders who rely on specific chart setups and indicators.

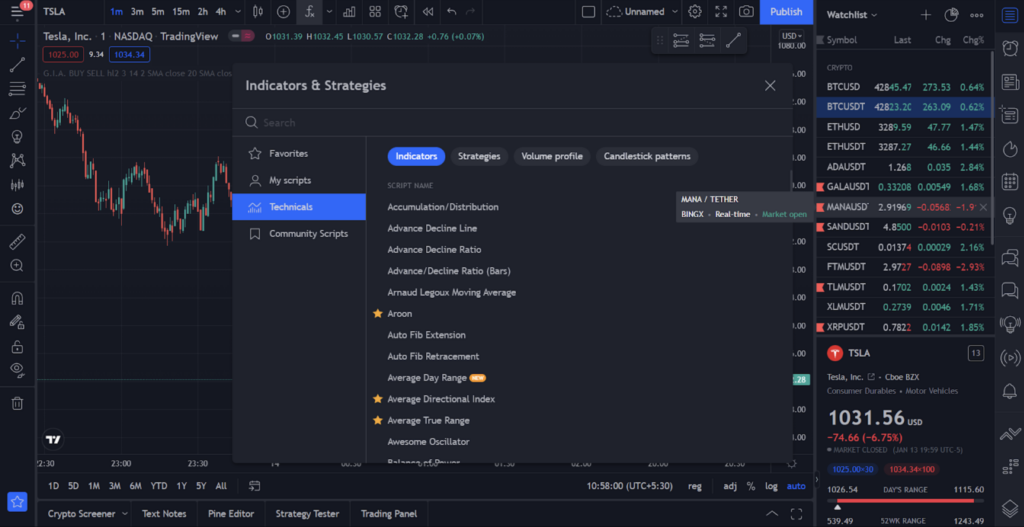

📌 Charting and Technical Analysis Tools

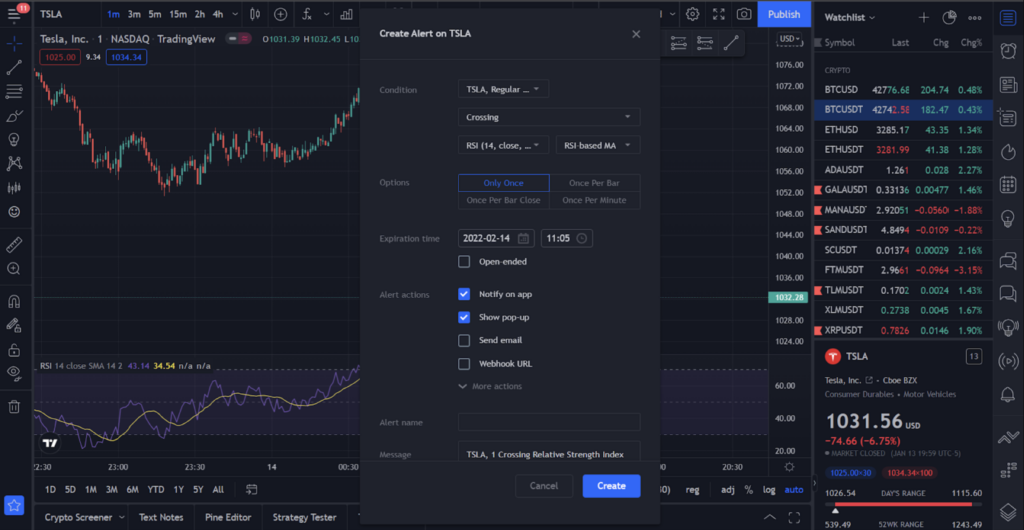

TradingView offers a wide range of chart types and an extensive library of technical indicators, catering to both novice and experienced traders.

Its interface is intuitive, making it easy to employ advanced drawing tools and conduct comprehensive technical analysis.

Conversely, TrendSpider specializes in automated chart pattern recognition, identifying over 200 patterns, which is a boon for technical traders. It provides unique tools like dynamic price alerts and heatmaps, tailored for in-depth technical strategies.

While both platforms excel in charting, TrendSpider is more focused on automation and advanced technical functionalities, appealing to traders who prioritize detailed analytical capabilities.

📌 Screening and Backtesting

📍 Nature of Screening Tools

TradingView offers screening tools that integrate both technical and fundamental analysis. This broad approach allows traders to filter stocks or other assets based on a wide range of criteria, including financial metrics, making it versatile for different trading strategies.

TrendSpider, in contrast, focuses more on technical screening. Its tools allow traders to combine various technical indicators and patterns for a more targeted approach, particularly useful for those who prioritize technical analysis in their trading decisions.

📍 Backtesting Functionality

TradingView requires users to utilize Pine Script, its proprietary scripting language, for backtesting. This approach offers robust and flexible backtesting options but requires a basic understanding of programming, which might be a barrier for some users.

TrendSpider offers a no-code backtesting environment. Traders can test their strategies using logical conditions without the need to write any code. This feature is particularly attractive for traders who lack coding skills or prefer a more straightforward approach to strategy testing.

📍 Integration of Screening and Backtesting

TradingView, screening and backtesting functions are distinct but complement each other. Users can use the screening tools to identify potential trading opportunities and then apply backtesting to test strategies on historical data.

TrendSpider integrates its screening and backtesting more closely. Its advanced screening capabilities are directly linked to backtesting, allowing traders to efficiently filter opportunities and immediately test them, which streamlines the entire process of strategy development and validation.

📌 Community and Learning Resources

TradingView takes a significant lead over TrendSpider. TradingView boasts a vibrant, active social community where users can share and discuss trade ideas, and strategies, and gain insights from fellow traders.

This is complemented by a rich repository of educational content, including tutorials and articles, making it a valuable resource for continuous learning and skill enhancement, especially for beginners.

On the other hand, TrendSpider, while offering a specialized Discord server for community interaction, lacks an integrated social platform within its system.

Its educational resources are more focused on maximizing the platform\\\’s technical capabilities, rather than providing a broad spectrum of learning materials.

This makes TradingView more appealing to those who value community engagement and a diverse range of learning tools as part of their trading experience.

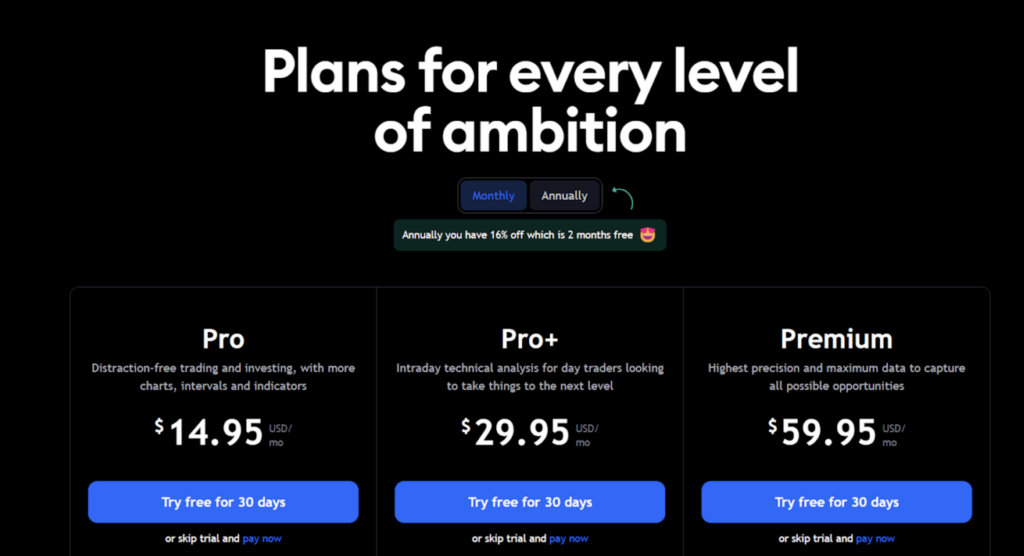

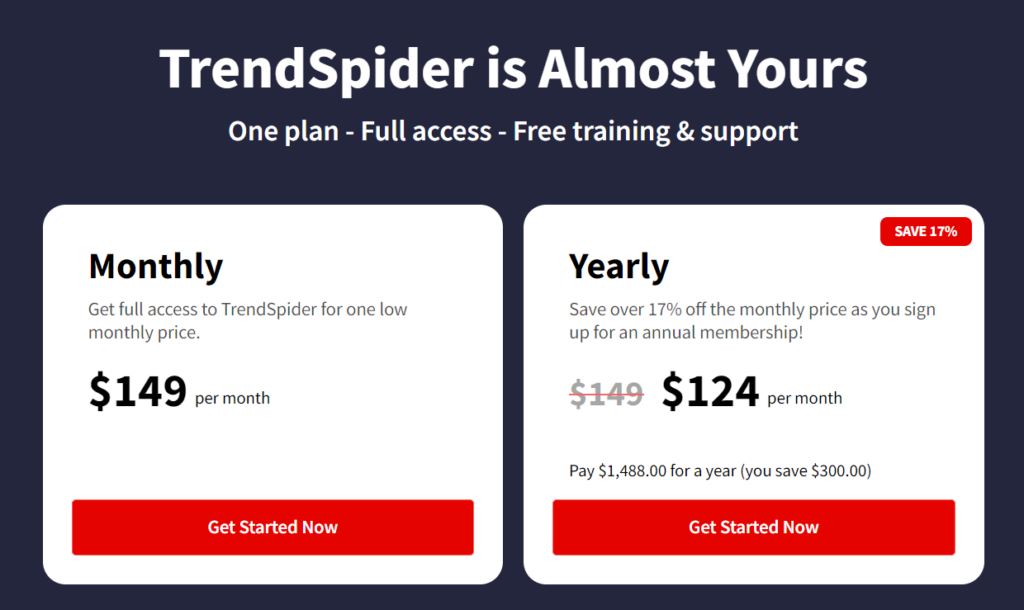

💸 Pricing and Subscription Models

| Feature/Plan | TradingView Essential | TradingView Plus | TradingView Premium | TrendSpider Essential | TrendSpider Elite | TrendSpider Elite Plus |

|---|---|---|---|---|---|---|

| Monthly Price | $12.95 | $24.95 | $49.95 | $39 | $79 | $179 |

| Annual Price (Monthly) | $32 | $65 | $135 | $32 | $65 | $135 |

| Annual Total | $384 | $780 | $1,620 | $384 | $780 | $1,620 |

| Free Trial | 30 days | 30 days | 30 days | 7 days | 7 days | 7 days |

| Discount for Annual Plan | 18% | 25% | 25% | 18% | 25% | Significant discount |

| Number of Charts/Layout | 2 | 4 | 8 | 2 | 4 | 8 |

| Indicators per Chart | 5 | 10 | 25 | – | – | – |

| Historical Bars | 10K | 10K | 20K | – | – | – |

| Price Alerts | 20 | 100 | 400 | 25 | 100 | 300 |

| Technical Alerts | 20 | 100 | 400 | – | – | – |

| Additional Features | Basic features | Enhanced features | Advanced features | Basic access | Full access | Full access plus extras |

📍 Note:

- ➡️ The features listed for each plan are not exhaustive but highlight key differences.

- ➡️ The specific features and tools available in each plan can vary, and users should check the latest details on the respective websites.

- ➡️ TrendSpider\\\’s features such as \\\”Indicators per Chart\\\” and \\\”Historical Bars\\\” are not explicitly listed as they focus more on automated analysis and pattern recognition, which are integral to all their plans.

- ➡️ TradingView offers more tiered and flexible pricing options, while TrendSpider focuses on providing more advanced tools at a higher price point.

📌 Broker Integration and Market Coverage

📍 TradingView

- Broker Integration: Allows direct trading from the platform with various brokers.

- Global Market Coverage: Offers a broad range of international markets.

📍 TrendSpider

- No Direct Broker Integration: Focuses more on analysis and strategy development rather than execution.

- Market Coverage: Primarily covers U.S. markets, with some international data.

📌 Customization and Advanced Features

In terms of customization and advanced features, TradingView and TrendSpider cater to different levels of user expertise and needs.

TradingView strikes a balance between offering advanced features and maintaining user-friendliness. It allows the creation of custom indicators through Pine Script, a proprietary scripting language, which provides flexibility yet keeps the complexity manageable. This makes it suitable for a broad range of traders, from intermediate to advanced.

On the other hand, TrendSpider leans more towards highly advanced customization. It offers the ability to create custom indicators using JavaScript, a more versatile and widely-used programming language, catering to users who are comfortable with deeper technical analysis. This focus on complex tools and in-depth customization options makes TrendSpider more appealing to experienced traders who require detailed and sophisticated analysis tools.

🔥 Final Says: Which One Should You Choose?

Choosing between TradingView and TrendSpider ultimately depends on your specific trading needs and preferences.

📍 Experience Level

- Beginners: TradingView is more user-friendly and suitable for those new to trading. Its intuitive interface and simpler tools make it easier for beginners to navigate and learn.

- Experienced Traders: TrendSpider caters to those with more experience in trading, offering advanced features and complex tools that are beneficial for in-depth technical analysis.

📍 Analysis Preference

- Technical Analysis & Pattern Recognition: TrendSpider excels in offering specialized tools for technical analysis, particularly in automated pattern recognition, making it ideal for traders who focus heavily on these aspects.

- Versatile Analysis: TradingView provides a more balanced approach, supporting both technical and fundamental analysis. This versatility makes it suitable for traders who employ a combination of these methods.

📍 Community Interaction

- TradingView has a robust community platform where traders can share ideas, learn from others, and access a wide range of shared content. This aspect makes it a great choice for those who value social learning and community engagement in their trading journey.

📍 Budget Considerations

- TradingView offers a more flexible and tiered pricing structure, including a free version, making it accessible for traders with different budget constraints. This range allows traders to choose a plan that aligns with their financial capacity.

📍 Market Focus

- International Markets: If your trading involves a global market focus, TradingView provides extensive coverage of international markets, making it a more suitable option.

- U.S. Markets: TrendSpider, while offering some international data, is more focused on U.S. markets and is tailored towards traders primarily dealing in these markets.

In summary, your decision should be based on your level of trading experience, the type of analysis you prioritize, how much you value community interaction, your budget, and the markets you are interested in.

Both platforms have their strengths, and the best choice is the one that aligns most closely with your individual trading needs and goals.