Has it ever happened to you that the trading strategy you create works excellently at first and you start encountering losing trades?

There is literally no way to testify and determine a strategy’s performance unless tried and tested on your chart.

Quantifying the risk involved with your trading strategy is the core fundamental of the Backtesting method. Rather than using some random tricks to calculate the effectiveness of your trading strategies, this article provides a step-by-step guide on how to backtest them.

What Is Backtesting?

Backtesting refers to the process of using historical data and implementing your trading strategies on them in order to identify the effectiveness of its performance.

Backtesting is one of the most important features in the trader’s toolbox which makes it even remotely possible for you to assess the accuracy of the strategy on all the available past data for the preferred symbol.

It is crucial to test the waters before actually getting into a real trading environment and ending up causing a mess of your financial conditions and trading goals.

Backtesting can be done either manually or automatically. In the manual procedure, investors or testers find out the probability of the success of the strategy whereas, in the automatic process, specialized software does the job for you.

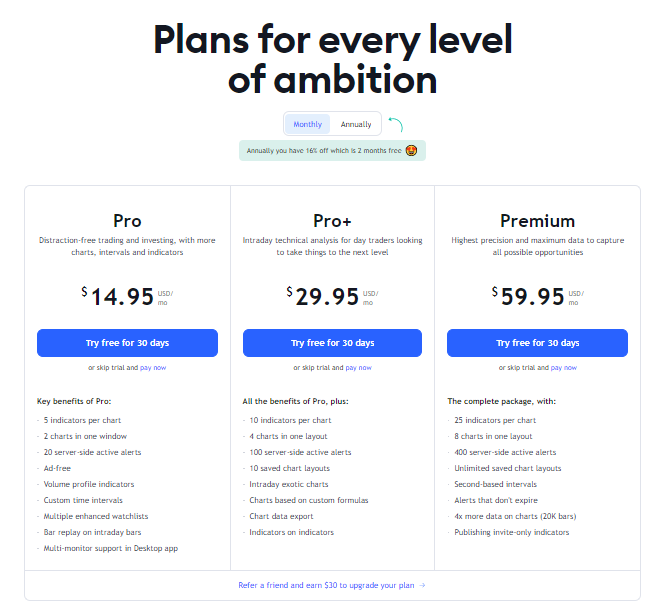

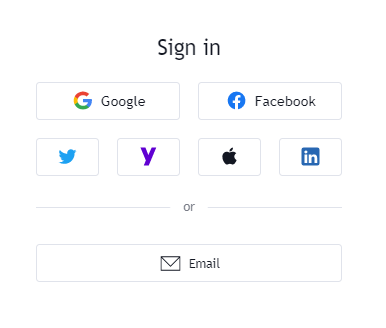

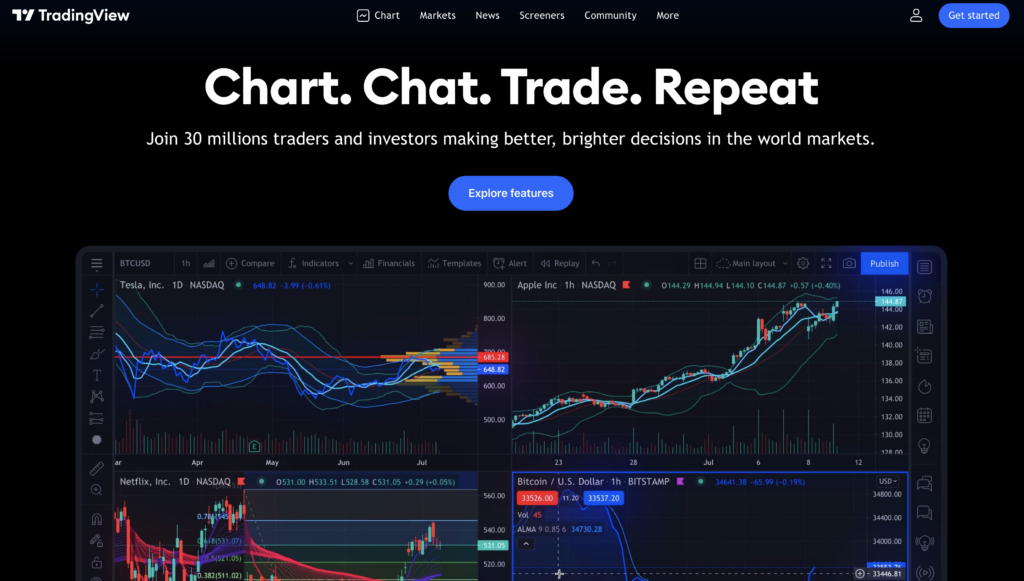

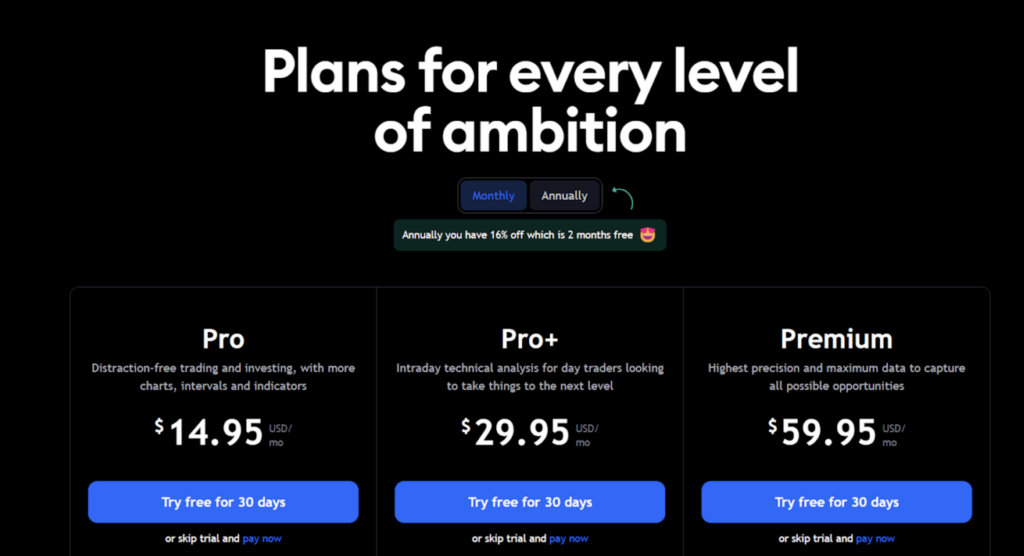

There are quite a number of platforms through which you can backtest your strategy, some paid and some free. One of the software platforms you can receive reliable results from is TradingView.

How To Backtest The Trading Strategy On TradingView?

TradingView not only allows you to test out your entire trading strategy in a bunch of trading situations but also grants you the permission to check out individual parts of a new strategy setup as well as candlestick formations. Follow the steps given below in order to backtest your trading strategies on TradingView.

1. Gather Data From a Wide Array Of Charts

The very first step of backtesting requires some kind of historic data which can range from a time frame between being from a few weeks ago or years.

If you are testing a supposedly short-term strategy on small time frames, use the trading data gathered from at least a couple of weeks ago. On other hand, if you are using higher time frames then use data from a recent few years.

2. Set Up The Parameters And Manage Risks

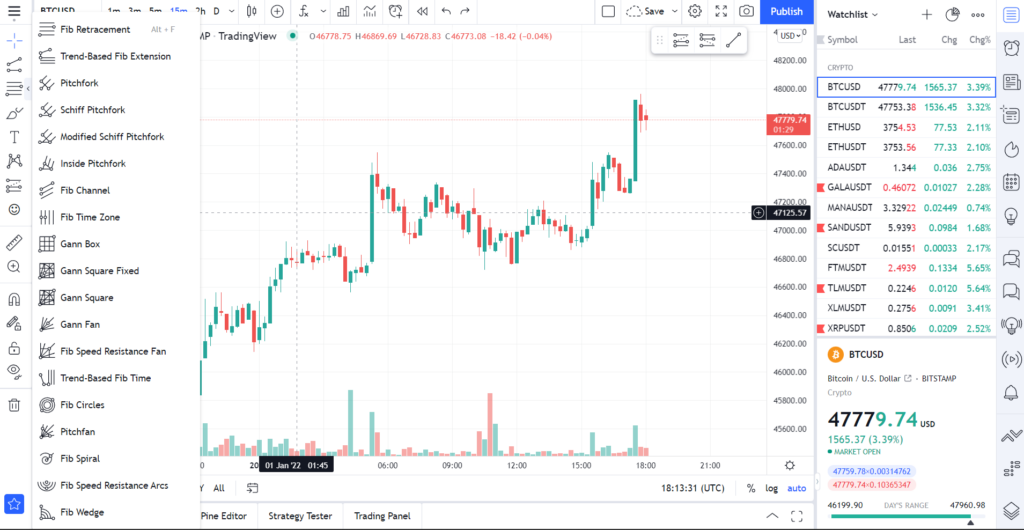

Next up you are required to define or set up parameters for your strategies such as exit conditions, and entry conditions as well as manage the amount you are willing to risk.

Try imposing as many conditions as possible in the form of “If X happens then execute Y”. This step also incorporates risk management and therefore you have to decide whether you are risking the same percentage on every trade and what specifically is this amount.

It is to be noted that all of the parameters are being used as basic rules for measuring and testing your strategies. These said parameters can be redefined at any given point to figure out which are more profitable than the other.

3. Use TradingView’s Rewind Tool

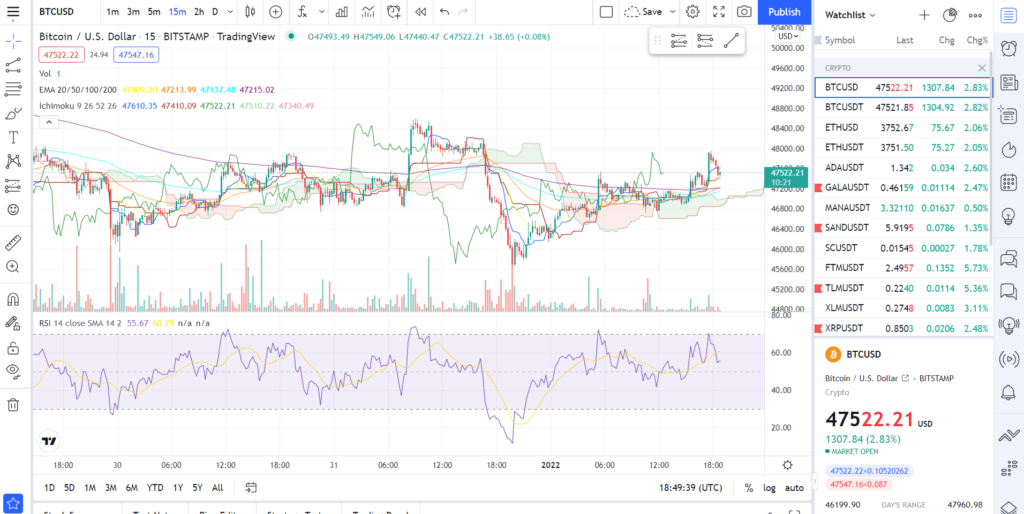

The platform offers a dedicated rewind tool that can be used to go back in time so that you can delete the predictive nature of where the deliberated chart is heading. This allows you the ability to look back at the trades no matter however far you wish, it can be years, months, or weeks in the past.

4. Analyze The Price Charts

Next up, you can monitor the price charts for entry as well as exit signals. Backtesting through all of the data takes time, more than just a session so be patient.

You can continue to deeply analyze the signals until and unless all of the trades up to the current time have been written or marked up on the chart.

5. Tally And Measure The Profits

After the whole process is finished you can start summing and totaling up all of your trade results in order to determine the profitability ratio of your chosen trading strategy over the period of time.

Quick Links

How To Do Paper Trading On TradingView: Complete Guide For Beginners

TradingView Review: Is This Platform Worth It In 2022?

How To Use TradingView: Easy Guide For Beginners & Expert

What Are The Pros And Cons Of Backtesting?

Backtesting has its own set of advantages and disadvantages and some of which are as follows.

Pros Of Backtesting

1. Backtesting your trading strategies does not involve real threats or repercussions of that live trading situation.

2. It helps traders get through knowledge and understanding of the market while researching and testing out strategies designed for real trading markets.

3. The backtesting provides a sense of direction to investors related to important investment decisions such as when and which assets to buy or sell.

4. Supported and accessible from a web-based platform you can test various trading commodities such as Bonds, Cryptocurrencies, Forex, etc.

Cons Of Backtesting

1. Testing strategies on small sample sizes of trading data or not testing enough and through can dramatically affect the performance as well as the results associated with the strategies during live trading.